Archive for September, 2008

Materialism & Overconsumption as a Broken Strategy

Andrew J. Bacevich, author of The Limits of Power, was interviewed by Bill Moyers. In the interview Dr. Bacevich highlights how America’s Ponzi-scheme of ever-expanding credit, energy addiction, and imperialistic military powers used to support endless materialism is not working out too well, and how we are in for a crash if we do not change our ways.

He also mentions that the biggest thing that needs changed is an internal problem rather than an external one, which is good news, as it is much easier to change how we act than force change onto others…though how could you win wide coverage in this country by preaching the virtues of thrift and moderation?

The Federal Reserve Giveth & US Treasury Taketh Away

Nice interview of Marc Faber on CNBC

“About 15 percent of U.S. households have negative equity. Who supplied the leverage into the system? It’s called the Federal Reserve Board,” Faber said.

“If I’m the drug dealer I’m not responsible that everybody takes drugs, but I facilitate it, especially if I give it out free of charge, I can enlarge the market share, and that’s what the Fed has done.”

President Bush went on national TV to try to sway the population that the proposed Wall Street bailout is a good plan, but is it? Chris Martenson describes it as act of financial terrorism, and The Greatest Looting Operation in History.

The bailout proposal, as originally presented (on Sat. 9/20/08), was shocking.

First, there was the sneaky language that the $700 billion figure was the most that could be spent at any one time, meaning that there was no limit on the spending at all. Second, the right of review by any court of law or other administrative body was to be stripped away, a distinctly unconstitutional and anti-American provision if ever there was one. Third, the Treasury Secretary was to be embodied with complete unitary power in selecting who was to be empowered with an open-ended taxpayer checkbook.

No review, no limits, no questions.

Marc Faber, expecting more shadiness from the US government, predicted that if this emergency measure/theft did not work well enough that…

“The next emergency measure will be that Americans are not allowed to buy foreign currency and transfer money overseas, and the next measure will be not permitting Americans to buy gold and so on and so forth…. It creates even more uncertainty in the market place when you continually change the rules,” Faber said.

It wouldn’t be the first time United States citizens had their gold confiscated. In 1933 Franklin D. Roosevelt issued executive order 6102, requiring all US citizens to hand all gold coins, gold bullion, and gold certificates over to the Federal Reserve. Shortly after confiscating all gold the price of gold from the treasury was raised from $20.67 to $35 an ounce, devaluing the US dollar by 41%.

Inflation vs Taxes

Some entreprenuers fear that Barak Obama might increase tax rates if he gets elected. But is it any different than what we just lived through? One savvy commenter recently stated “One party will strangle us with taxes, the other will strangle us with inflation. Care to tell me the difference?”

Barrons recently published an article titled Spinning a Grand Old Fantasy, highlighting how the Republican party has become the party of big government and socialism (at least for the rich):

Democrats are depicted as the party of big, intrusive government, willing to “ignore fiscal problems while squandering billions on ineffective programs.”

The GOP, however, has no moral legs to stand on when it hurls such insults.

The Bush administration has bailed out Wall Street, and stands ready to bail out mortgage giants Fannie Mae and Freddie Mac — in the process abetting a slide into more intrusive government. If we are headed down the road to socialism, then the GOP can be credited with setting the pavers.

Because inflation happens, we just assume it is part of the economy. We typically do not lay blame on anyone for inflation – except in some cases claiming merchants are greedy, but that statement misses the cost of inflation and who controls it – inflation is largely controlled through the money supply. Grow the federal debt and money supply faster than the population and you have inflation. Inflation is an intentional economic strategy, one which had no lasting role in our economy from 1776 to 1913, but has been present ever since the Federal Reserve was created

| Taxes | Inflation | |

| Income | Only hits you after your business expenses are paid and you have reinvested in growth. It only touches a small part of the business, while the core business is allowed to grow logarithmically untouched. | Hits the first dollar you earn and the first dollar you spend. Affects every dollar of profit as well as all the other money associated with your business and your personal life. |

| Earnings vs savings | Only takes from your earnings. Does not hurt your savings. | Robs from your earnings and cash savings. Forces you to make risky investments with your savings if you want to outpace inflation. |

Chris Martenson has a great video on inflation.

World’s Largest Credit Card

| National Debt Clock |

|

|

The United States already has a debt nearing $10 Trillion, much greater if you include unfunded liabilities like Medicare and Social Security. Richard W. Fisher, President of the Dallas Federal Reserve pegs the number closer to $100 trillion. Mr. Fisher ended his speech with this quote about weakness of the US Dollar.

Of late, we have heard many complaints about the weakness of the dollar against the euro and other currencies. It was recently argued in the op-ed pages of the Financial Times that one reason for the demise of the British pound was the need to liquidate England’s international reserves to pay off the costs of the Great Wars. In the end, the pound, it was essentially argued, was sunk by the kaiser’s army and Hitler’s bombs. Right now, we—you and I—are launching fiscal bombs against ourselves. You have it in your power as the electors of our fiscal authorities to prevent this destruction. Please do so.

That speech has fallen on deaf ears.

U.S. Treasury secretary Henry Paulson pushed through a banking industry bailout plan which grants the Treasury authority to issue up to $700 billion of Treasury securities to finance the purchase of troubled residential and commercial mortgage-related assets, which may include whole loans and mortgage-backed securities. The Seretary may work with the Fed to purchase any other assets they deem necessary to stabilize the financial markets. Worse yet, the Treasury’s actions may not be reviewed – by any administrative agency or court of law.

Unelected quasi-governmental officials have a limitless credit card to buy junk at whatever price they see fit, and nobody can review or overturn their purchases.

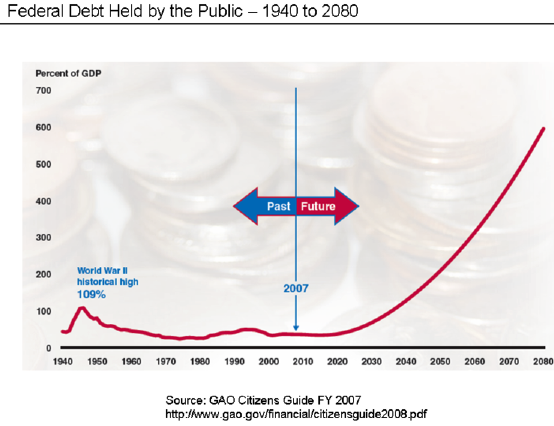

What does the future look like? Pretty ugly. This chart was made before the above bailout and limitless credit card came to be.

Every 20 Years Wall Street Loses its Mind

I was talking to a friend last night about the economy, and he stated the above quote…noting that the market has a short memory. Every bubble in history is built on the thought that this time is different, but opportunity leads to opportunism leads to corruption leads to collapse. Trade away the future until there is nothing left, and then start over again.

The Daily Show offers a humorous look at the economy and you

With the recent worries on Wall Street leading to government bailout after bailout deregulation failed badly.

We now see that the grand experiment of deregulation has ended, and ended badly. The deregulation movement is now an historical footnote, just another interest group, and once in power they turned into socialists. Indeed, judging by the actions of the conservatives in power, and not the empty rhetoric that comes out of think tanks, the conservative movement has effectively turned the United States into a massive Socialist state.

The problem is not regulation, but short term opportunism. People will always work within the limits of the loopholes that exist. Regulators can at best be one step behind.

Unless corporations have a real opportunity cost that prohibits them from fudging the numbers the standard will be fraud, or step away from it…every time there is a bubble we can expect the whole market to chase it, especially if the government undermines moral hazard and saves these companies that should no longer exist.