Giving Credit Where it is Due

It sorta seems like the US is backed into a bit of a corner. At least temporarily. A big part of the reason I have considered moving is just the general uncertainty. It is pretty clear that the trend is going to be a lower standard of living across the board. The question is how will people react to it? This year and next year no cost of living adjustment for Social Security. Numerous food commodities are up 30% to 80% over the past 3 months, the US Dollar index is down about 13%, and in spite of having excessive liquidity in the system Ben Bernake keeps jawboning further easing to paper over the fraud from his banking buddies.

The big issue is that those who committed the crimes which have caused the instability have not been punished, but rather rewarded. They claim that oversized record bonuses are needed to retain the best and the brightest, but when they crash the system they play naive:

They can’t have it both ways. First they said that the brightest and most talented Americans work at these companies and therefore they need to be paid millions to keep them. And then when something like this happens they can’t claim incompetence. So yeah I with Black on this one after all he had plenty of experience dealing with very corrupt bankers.

Rather than enforcing the rule of law, there has been a gradual evolution of the creation of a mechanism for systemic economic fraud which will become legal after the fact due to “systemic risk”

The financial industry functions on the assumption that contracts and activities that are either illegal or unenforceable under current law will – as long as they involve significant bank losses or liabilities – always be made legal retroactively.

Over the past half century the financial industry has not treated the law as a bedrock institution that constrains the nature of its activities, but rather as a set of rules that can be forced to adapt to the industry’s needs and desires. Thus, the industry knowingly and deliberately creates standardized contracts that are either designed to circumvent the law or in some cases flatly illegal under current interpretations of the law, and then when a case involving the contract arises (which in many instances happens only long after the standardized contract has become an institution), the financial industry tells the court that the dubious or illegal contract is so widespread that the court would create systemic risk by enforcing the law.

The issue with foreclosure mill policies is not just the end outcome

“The mortgage servicers hired people who would never question authority,” said Peter Ticktin, a Deerfield Beach, Fla., lawyer who is defending 3,000 homeowners in foreclosure cases. As part of his work, Ticktin gathered 150 depositions from bank employees who say they signed foreclosure affidavits without reviewing the documents or ever laying eyes on them — earning them the name “robo-signers.”

The deposed employees worked for the mortgage service divisions of banks such as Bank of America and JP Morgan Chase, as well as for mortgage servicers like Litton Loan Servicing, a division of Goldman Sachs.

but all the other stuff they are hoping to hide in rushing fraud through the courts. The fraud is so fast and so furious that title insurers won’t even insure titles foreclosed on by its own attorneys: “The title insurance arm of one of the state’s largest foreclosure law firms is refusing to cover properties foreclosed on by its own attorneys citing potential defects in court filings.

The creation of a banana republic is the obvious outcome of current policy:

Either there is due process of law or you have a kleptocracy/”banana republic” oligarchy. At present, that is the decision we face as a nation. If the banking Elites and their partners in the Central State (Fed and Treasury) are allowed to “win” and gut the property laws of the states, then the U.S.A. will be revealed as a kleptocracy/”banana republic” oligarchy.

If state laws are upheld, then the “too big to fail” banks are insolvent and they will fail. Then the question of kleptocracy arises once again: will the banks be allowed to fail as per Classic Capitalism, that is, their owners and managers will have to absorb the losses of that bankruptcy/failure, or will the Central State use its powers to collect taxes and cover the private losses of the Bank/Financial Power Elites? Privatizing profits and socializing losses has been the entire game plan since the global house of cards collapsed in 2008.

It’s decision time, citizens. Either the banks/Central State “win” and we are a kleptocracy/ “banana republic,” or they lose and the U.S. mortgage/ banking sector implodes and is either formally socialized (i.e. owned lock, stock and barrel by the Central State) or rebuilt from scratch without big banks, Federal guarantees and the Fed’s incestuous interventions. (“We create the credit that enables the mortgage, you issue the mortgage, and then we buy the mortgage.”)

The Nuclear Option

Michael Pettis has a killer post on why China won’t use the nuclear option & what the near term future likely holds.

The US, in other words, is not likely to face the “nuclear option” of a Chinese disruption of the US Treasury bond market. It is far more likely to be swamped by a tsunami of foreign capital. This tsunami will bring with it a corresponding surge in the US trade deficit and, with it, a rise in US unemployment. It will also force the US Treasury to increase the fiscal deficit as more of the jobs created by its spending leak abroad.

The Media’s Fly-like Memory

Great quote from Eric at iTulip

Ten years from now, when the full impact of the U.S. asset bubbles of 1998 to 2008 are fully felt, the dot com era, when money flowed like oil from a geyser, before the wars and financial crisis, will be remembered as the good old says, the high water mark for American power and influence.

As American living standards decline for broad swaths of the population, first by underemployment and unemployment, then by inflation, the thread of cause and effect will be lost by a media that’s forced by its consumers to report daily events without context, as if the latest crisis fell out of the sky, from the clouds.

Nobody saw this coming*

* except those who profited from creating the bubble & are profiting once more from it popping 😉

But the media does give us what we want: 😉

The recent performance of the U.S. political system at the relatively simple task of getting more health care to Americans at a lower cost does not encourage optimism. A debate about the value of reducing the 40% health care cost overhead created by health insurance companies was turned seemingly overnight by the health insurance industry’s media into an free-for-all about death panels and socialism. Now imagine how swiftly a discussion about needed cuts in military spending to help bring the budget deficit in line will be turned by the military industrial complex into a media circus about aiding terrorists, replete with images of nuclear weapons going off on American soil.

Hard Money vs Fiat Currency

Karl Denninger explained why hard money is not as good in application as it is in theory:

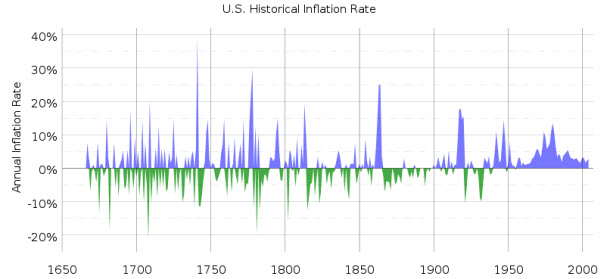

The inflationary and deflationary spikes are caused by the nature of “hard currency”; once dug out of the ground gold, for example, is not destroyed. When innovations in productivity outrun the ability to provision new currency reserves deflation ensues as the mining rate cannot keep up – the resulting deflation causes business and personal bankruptcies. This in turn causes a contraction in GDP but that cannot be balanced with a withdrawal of the currency base since it already exists! The result is a punishing swing between severe bouts of inflation and deflation; this is unacceptable.

Yet our currency still has a significant bias to it…

Yet the history of our fiat money regime as practiced to date, while perhaps “better” in terms of violence, certainly isn’t in terms of bias, which is clearly inflationary, all the time. Why? Simple: Given the proclivity of “choice” the monetary authorities will always choose to try to paper over their friend’s mistakes! This requires inflation, not deflation.

Inflation acts as a silent tax that few Americans actually understand. And so it makes it easy for politicians to spend a bit more without raising taxes. It is politically acceptable to steal a few percent a year from the populous because most just think it happens and few understand that Inflation is Always and Everywhere a Monetary Phenomenon, as Milton Freedman said. I think soft money (coupled with cooking the books on CPI to understate inflation + encouraging short term compensation strategies that encourage massive moral hazard) have a tendency to create less violent year to year changes in inflation, but creates much larger bubbles. So we get improved short term efficiency and more perceived short term stability at the expensive of great instability that blows up every other decade or so.

Bill Black on Modern Accounting Fraud

- Accounting fraud creates short term accounting profits followed by huge losses.

- At its peak 40% of mortgages in the United States were not prime!

- The average CFO in America lasts ~ 3 years. If your rivals engage in accounting fraud and you do not then you last much less than that average…maybe a quarter or 2. Bad ethics drive good ethics out of the market.

Bruce Bartlett’s The GOP’s Misplaced Rage is another lens on the politics behind the real estate bubble.

“Better” Than the Third World…

Nice summary by Eric Jantszen:

Bribery in third world countries goes on under the table, behind closed doors, hidden from nosy journalists. In the U.S. bribery of public officials occurs in broad daylight, paid out as speaker’s fees and advisor’s compensation.

I know, I know. You don’t want to hear this. The crisis passed. Green shoots and all that. Jon Stewart’s dressing down of Jim Cramer? Dismissed. The assertion by Bill Black, the senior federal savings and loan regulator during the S&L crisis, to Bill Moyers that the current banking crisis is “1000 times worse, perhaps, certainly 100 times worse, than the Savings and Loan crisis” yet no one has been prosecuted? Forgotten. The revelation from Simon Johnson, Director of the Research Department at the IMF and Sloan School of Management at MIT Professor of Entrepreneurship, that the U.S. is not run by either Republican or Democratic parties but by a American bank oligarchs?

Senator Dick Durbin, who has used his inside information to trade the market, has publicly stated the truth on the matter

“And the banks — hard to believe in a time when we’re facing a banking crisis that many of the banks created — are still the most powerful lobby on Capitol Hill. And they frankly own the place.”

Anytime you trade, you are trading against this inside info and corruption. When you lose you lose. When you win you get taxed, and your funds still end up in the hands of the corrupt bankers and investment firms like Goldman Sachs.

It’s better than the third world. Up until the point it isn’t!

Debt is Accounting, Not Reality

Barry Ritholtz highlighted a great downloadable PDF from Jeremy Grantham of GMO titled The Last Hurrah and Seven Lean Years

It is well worth a read, but here are a few great highlights from it

- “Debt is accounting, not reality. Real economies are much more resilient than they are given credit for.”

- Attempts at economic stimulation tends to stimulate the stock market more than the economy because it trades off momentum & a multiplier effect.

- “Since 1932, in the third year of the Presidential Cycle, the average S&P 500 return (from October 1 to October 1) is 22 percentage points ahead of the average of years one and two! And this is statistical noise? Year three is the time when, driven by politics, financial stimulus and moral hazard are applied so that the economy – particularly increases in employment – can be a little stronger in the run-up to the election in year four.”

Stealing Money for Me – Quote of the Day

I was chatting with a friend yesterday and he said:

“Once I saw the PPIC from Geithner, I decided to channel my anger, and I bought a bunch of bank stocks. So now I can be happy knowing that the govt is stealing money FOR ME, instead of just FROM me”

He really captures the spirit of our free market capitalism.

I pledge allegiance

to the banks

of the United States of America,

and to the interest for which it stands,

one nation under debt, indefinitely,

with brazen looting & slavery for all.

The Morality of Loan Payments

As far back as 2004 the F.B.I warned of an epidemic of mortgage fraud and yet boosters were promoting the real estate industry through 2008 with rosy predictions that proved false. Some of those same boosters (who want you to believe you are immoral if you default on a loan) have decided to walk away from their homes. Based on their own actions they have zero moral authority over your actions:

The government is heavily invested in seeing the banks get the better end of this situation (of their own making!) even if it impoverishes you in the process. Only you, in consultation with an attorney and CPA, can make a business decision on whether to attempt to renegotiate and/or walk away – that is, what the best business decision is for you – and only you. Make that decision not based on the bleating claims of morality among those who either intentionally misled you or sat silently while firms and individuals over whom they had regulatory authority did so, but rather strictly as a business decision. After all – they both did a few years ago and are again – here and now – today.

This William K. Black interview does a nice job of explaining the modern system of banking fraud.

The Joys of Protectionism + Inflate or Die

Recently Mexico said they will be launching tariffs some products from the US because the United States canceled a program that allowed Mexican trucks to transfer goods throughout the US

The Mexican government said Monday it would slap tariffs on 90 U.S. industrial and agricultural products, in a trade dispute that underscored the difficulties facing President Barack Obama as he tries to assure business and global allies that he favors free trade.

Mexico said the tariffs were in retaliation for the cancellation of a pilot program allowing Mexican trucks to transport cargo throughout the U.S.

Unions have for years fought to keep Mexican trucks off U.S. highways, despite longstanding agreements by the two countries to eventually allow their passage. Legislation killing the pilot program was included in a $410 billion spending bill Mr. Obama signed last week.

Currency, as a type of good, is also being heavily manipulated, with countries around the globe trying to out-inflate each other to make their exports cheaper to foreign consumers. Even the Swiss have recently intervened.

The Chinese warned the US against printing too much currency. But the US federal government deficit could easily hit 2 trillion Dollars this year, and the Federal Reserve is buying up hundreds of billions of dollars in bonds across the yield curve to try to push down interest rates.

The Federal Reserve ramped up its efforts to resuscitate the sagging economy, saying it would purchase up to $300 billion of long-term U.S. Treasury securities in the next few months and hundreds of billions of dollars more in mortgage-backed securities.

By buying long-term government bonds and mortgage-backed securities, officials hope to push up their prices and bring down their yields, and thereby energize the economy. Interest rates on many corporate bonds and consumer loans are benchmarked to U.S. Treasury debt.

Deflation has begun receding, and if/when inflation appears it may force the Federal Reserve to slow down the U.S. economy again.

Feb CPI rose .4% headline, .1% more than expected and rose .2% core, also .1% more than estimated. The y/o/y gain is .2% up from flat in Jan, the lowest since 1955, led by energy. The core rate is up 1.8% y/o/y. With oil prices bottoming out as are food prices, which I believe is for good in this cycle, inflation #’s are starting to reverse to the upside. The degree of course will determine the Fed’s next conundrum.

Long-term it seems like hyperinflation is a no brainer bet, but in the meantime the house is using your money to bet against you, propping up whatever they can. How far will they take it?