Archive for the ‘credit’ Category

The Nuclear Option

Michael Pettis has a killer post on why China won’t use the nuclear option & what the near term future likely holds.

The US, in other words, is not likely to face the “nuclear option” of a Chinese disruption of the US Treasury bond market. It is far more likely to be swamped by a tsunami of foreign capital. This tsunami will bring with it a corresponding surge in the US trade deficit and, with it, a rise in US unemployment. It will also force the US Treasury to increase the fiscal deficit as more of the jobs created by its spending leak abroad.

The Morality of Loan Payments

As far back as 2004 the F.B.I warned of an epidemic of mortgage fraud and yet boosters were promoting the real estate industry through 2008 with rosy predictions that proved false. Some of those same boosters (who want you to believe you are immoral if you default on a loan) have decided to walk away from their homes. Based on their own actions they have zero moral authority over your actions:

The government is heavily invested in seeing the banks get the better end of this situation (of their own making!) even if it impoverishes you in the process. Only you, in consultation with an attorney and CPA, can make a business decision on whether to attempt to renegotiate and/or walk away – that is, what the best business decision is for you – and only you. Make that decision not based on the bleating claims of morality among those who either intentionally misled you or sat silently while firms and individuals over whom they had regulatory authority did so, but rather strictly as a business decision. After all – they both did a few years ago and are again – here and now – today.

This William K. Black interview does a nice job of explaining the modern system of banking fraud.

The Perspective You Never Hear on Debt

Negative Equity Mortgage Modifications vs Cram Downs – Which is Worse?

The mortgage market is such a mess that it is being covered on 60 minutes.

Some of the mortgage loan modification “fix” programs are pretty crappy, trying to turn underwater homeowners into indentured slaves:

Home owners! Accepting this ’solution’ means you:

- acknowledge the full debt regardless of the value of the home;

- waive all rights to fraudulent or predatory lending claims in the future;

- turn your loan into a full recourse loan that could follow you for life even if you choose foreclosure down the road;

- remain underwater, full-leveraged, renter for the rest of your life (in most cases);

- will save no money at 38% housing debt-to-income ratio plus all other debts;

- may not discharge any of this mortgage debt through any bankruptcy even after foreclosure;

If widely accepted by home owners, this will ruin the American consumer and make housing a dead asset class for decades. If you are in a serious negative equity position when signing these forms, as most are, remember that you will:

- never be able to sell your home

- never be able to buy a new home

- never be able to rent your home due to owner occupant provisions

- be responsible for the full loan amount even if the value of your home keeps dropping for the next 10-years.

The 38% debt-to-income ratio on top of all of your other debt means you will save no money and live hand to mouth to keep this underwater roof over your head.

The alternative to the never-ending mortgage loan would be to cram down the mortgage principals to an amount that could actually be paid back. The blog post linked to had a couple great comments about why cram downs would be just in this case. Not only were many home buyers duped into these loans by criminals, but cram downs exist on virtually every type of loan except for primary residence loans:

Currently, in bankruptcy, every other type of property which is used as collateral for a loan, other than a primary residence, was subject to a “cram- down.” The only reason I can figure that primary residences were recently excluded from cram-down was so that average Americans could be taken advantage of by creditors. (This proves once again that our Congress is owned by the finance industry.)

If you don’t like cram-downs for primary residences because contracts are sacred, then why are cram-downs allowed for every other type of property. You name it, private jets, vacation homes, luxury yachts, machine tools, ect. are all CURRENTLY subject to the cram-down. Its absurd that only home mortgage contracts are sacred. Simply put, screwing the little guy is what the cram-down exception on primary residences is all about. There is simply no reason to allow primary residences to be treated differently than every other type of property.

and

Well, a contract is as good as your legal team. Chapter 11 is pretty cool with contracts: Shred it. Thought you had a deal, a labor agreement, a pension — well you did. Management gets a bonus as they enter the market again, cleansed of all their sins. The government encouraged commercial banks to hold preferred in F and F, and what happens?

And as far as “mark of a free society”, maybe you’ll be able to appreciate your situation . I’m one of those conservatives that figures all societies are feudal — despite disguises. Notice the King has opened the grain stores for the chosen.

Your pension can suffer from cram down, and nearly every type of asset qualifies for them – except primary residence. The bankers can get a multi-trillion dollar bailout for engaging in massive fraud, but you are a pile of crap if you don’t pay all your debts. At least your tax dollars are hard at work, working against you to prop up our Ponzi scheme banking system. Further proof that the American dream of owning your own home is one with a high price tag attached.

Catfish Industry, Commercial Real Estate Developers Asking for Bailouts

It seams consumer mortgage was just one piece of the cycle, and the news is getting worse every day. And the approach to fixing it (leaving consumers up to their eyes in debt while bailing out the banks) fails to account for the positive feedback loop from falling consumer demand.

We are already bailing out mortgage (Fannie Mae & Freddie Mac), insurance (AIG), the banks, autos, and now the cancer is spreading…where government funds are being asked for by hedge funds and commercial real estate developers.

From the Financial Times:

Hedge funds will be allowed to borrow from the Federal Reserve for the first time under a landmark $200bn programme intended to support consumer credit.

The Fed said on Friday it would offer low-cost three-year funding to any US company investing in securitised consumer loans under the Term Asset-backed Securities Loan Facility (TALF). This includes hedge funds, which have never been able to borrow from the US central bank before, although the Fed may not permit hedge funds to use offshore vehicles to conduct the transactions.

From the WSJ

With a record amount of commercial real-estate debt coming due, some of the country’s biggest property developers have become the latest to go hat-in-hand to the government for assistance.

They’re warning policymakers that thousands of office complexes, hotels, shopping centers and other commercial buildings are headed into defaults, foreclosures and bankruptcies. The reason: according to research firm Foresight Analytics LCC, $530 billion of commercial mortgages will be coming due for refinancing in the next three years — with about $160 billion maturing in the next year. Credit, meanwhile, is practically nonexistent and cash flows from commercial property are siphoning off.

Look for more violent swings in SRS. I wonder how far along talks are, and how this news will influence the market.

Nassim Taleb, author of The Black Swan, remains uncertain and hopes the situation is not getting worse:

But the extent of the bailout requests is absurd. Even the catfish industry is asking for $50 million, as reported by the (now bankrupt) LA Times:

“The catfish industry is on the verge of collapse,” said Marty Fuller of the Catfish Farmers of America, citing high feed prices and an increase of imports. About 6,000 jobs are at stake, mostly in economically depressed areas in states such as Arkansas, Mississippi, Alabama and Louisiana. Officials are talking about seeking $50 million in aid as a stimulus.

As Barry Ritholtz said, “Capitalism without failure is like religion without sin.” How many industries can the US government bailout before the dollar collapses? Looking at all the bailouts makes me want to go on vacation, rather than earning a lot of money so it can be confiscated by taxes and handed to crooks.

I can’t wait to read Bailout Nation! Great timing on the book, though I imagine there will be a need for an update in another year or two.

Credit Card Issuers Unite to Force Consumers Into Bankruptcy?

The NYT published an article about the credit card industry, highlighting steep cuts some lenders are makings. One of the more surprising aspects of the article was that shoppers were being profiled against other shoppers for credit cuts.

Lenders are shunning consumers already in debt and cutting credit limits for existing cardholders, especially those who live in areas ravaged by the housing crisis or who work in troubled industries. In some cases, lenders are even reining in credit lines after monitoring cardholders who shop at the same stores as other risky borrowers or who have mortgages from certain companies.

While such changes protect lenders, some can come back to haunt consumers. The result can be a lower credit score, which forces a borrower to pay higher interest rates and makes it harder to obtain loans. A reduced line of credit can also make it harder for consumers to manage their budgets, because lenders have 30 days to notify their customers, and they often wait to do so after taking action.

So the lenders offer you a credit line that gives you a false sense of security, and pull the rug out from underneath you when you need to rely on that offer. Then they don’t even let you know until you have reached your new lower limit or a month has passed.

Pricing risk behaviorally further increases the risks to the poorest of the poor. Lets say a person gets laid off or has a bad earning month and shop at Aldi (a discount grocery store). Based on risk assessments associated with shopping habits, acting responsible and living more frugally may increase the chances of a consumer getting their credit line pulled and going bankrupt.

Snce the consumer bankruptcy law was rewritten by MBNA in 2005, consumers can’t get bailed out the way the bankers just did. If the consumer dies then so does the economy. But nobody cares about the consumer, and the consumers won’t realize it until they are a day late and a dollar short.

It’s My Money, And I Need it Now

Or was it it’s my money, and they want it now?

The Wall Street Journal reports that the taxpayer funded corporate candy banking bailout is getting requests from all corners of the markets, with handout requests coming from insurance agencies, car manufacturers, and other industries:

The U.S. Treasury Department is considering taking equity stakes in insurance companies, a sign of how the government’s $700 billion program has become a potential piggybank for a range of troubled industries. The availability of government cash is drawing requests from all corners, with insurance firms, auto makers, state governments and transit agencies lobbying for a piece of Treasury’s pie. While Treasury intended for the program to apply broadly, the growing requests could rapidly deplete the $700 billion, an amount that initially stunned many as being quite large.

Barry Ritholtz once said that “Capitalism without failure is like religion without sin.” And even before this government handout is done the toxic effects are already kicking in, with investors worrying that banks that did not get a handout are set up to fail:

The Treasury Department has decided to let banks individually announce that the government will invest in each firm, scrapping an earlier plan to release the names of multiple banks receiving federal money all at once. The decision came after concerns that banks left off any group list would appear too weak for government assistance, spooking investors and depositors and potentially making troubled banks’ situations more dire.

With enough handouts appearance becomes reality. Spread that across dozens of industries and people will make a lot of false assumptions, killing many good businesses in favor of larger and sloppier competitors.

Materialism & Overconsumption as a Broken Strategy

Andrew J. Bacevich, author of The Limits of Power, was interviewed by Bill Moyers. In the interview Dr. Bacevich highlights how America’s Ponzi-scheme of ever-expanding credit, energy addiction, and imperialistic military powers used to support endless materialism is not working out too well, and how we are in for a crash if we do not change our ways.

He also mentions that the biggest thing that needs changed is an internal problem rather than an external one, which is good news, as it is much easier to change how we act than force change onto others…though how could you win wide coverage in this country by preaching the virtues of thrift and moderation?

Inflation vs Taxes

Some entreprenuers fear that Barak Obama might increase tax rates if he gets elected. But is it any different than what we just lived through? One savvy commenter recently stated “One party will strangle us with taxes, the other will strangle us with inflation. Care to tell me the difference?”

Barrons recently published an article titled Spinning a Grand Old Fantasy, highlighting how the Republican party has become the party of big government and socialism (at least for the rich):

Democrats are depicted as the party of big, intrusive government, willing to “ignore fiscal problems while squandering billions on ineffective programs.”

The GOP, however, has no moral legs to stand on when it hurls such insults.

The Bush administration has bailed out Wall Street, and stands ready to bail out mortgage giants Fannie Mae and Freddie Mac — in the process abetting a slide into more intrusive government. If we are headed down the road to socialism, then the GOP can be credited with setting the pavers.

Because inflation happens, we just assume it is part of the economy. We typically do not lay blame on anyone for inflation – except in some cases claiming merchants are greedy, but that statement misses the cost of inflation and who controls it – inflation is largely controlled through the money supply. Grow the federal debt and money supply faster than the population and you have inflation. Inflation is an intentional economic strategy, one which had no lasting role in our economy from 1776 to 1913, but has been present ever since the Federal Reserve was created

| Taxes | Inflation | |

| Income | Only hits you after your business expenses are paid and you have reinvested in growth. It only touches a small part of the business, while the core business is allowed to grow logarithmically untouched. | Hits the first dollar you earn and the first dollar you spend. Affects every dollar of profit as well as all the other money associated with your business and your personal life. |

| Earnings vs savings | Only takes from your earnings. Does not hurt your savings. | Robs from your earnings and cash savings. Forces you to make risky investments with your savings if you want to outpace inflation. |

Chris Martenson has a great video on inflation.

World’s Largest Credit Card

| National Debt Clock |

|

|

The United States already has a debt nearing $10 Trillion, much greater if you include unfunded liabilities like Medicare and Social Security. Richard W. Fisher, President of the Dallas Federal Reserve pegs the number closer to $100 trillion. Mr. Fisher ended his speech with this quote about weakness of the US Dollar.

Of late, we have heard many complaints about the weakness of the dollar against the euro and other currencies. It was recently argued in the op-ed pages of the Financial Times that one reason for the demise of the British pound was the need to liquidate England’s international reserves to pay off the costs of the Great Wars. In the end, the pound, it was essentially argued, was sunk by the kaiser’s army and Hitler’s bombs. Right now, we—you and I—are launching fiscal bombs against ourselves. You have it in your power as the electors of our fiscal authorities to prevent this destruction. Please do so.

That speech has fallen on deaf ears.

U.S. Treasury secretary Henry Paulson pushed through a banking industry bailout plan which grants the Treasury authority to issue up to $700 billion of Treasury securities to finance the purchase of troubled residential and commercial mortgage-related assets, which may include whole loans and mortgage-backed securities. The Seretary may work with the Fed to purchase any other assets they deem necessary to stabilize the financial markets. Worse yet, the Treasury’s actions may not be reviewed – by any administrative agency or court of law.

Unelected quasi-governmental officials have a limitless credit card to buy junk at whatever price they see fit, and nobody can review or overturn their purchases.

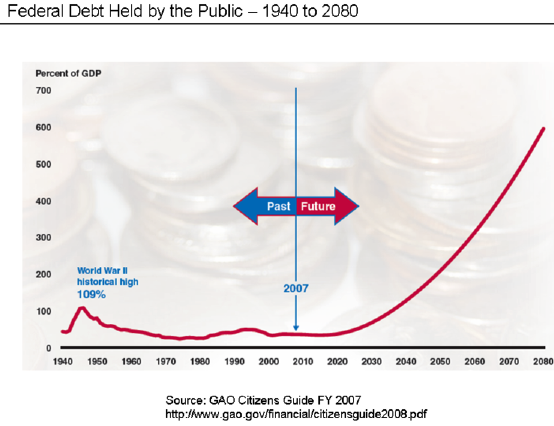

What does the future look like? Pretty ugly. This chart was made before the above bailout and limitless credit card came to be.