Archive for October, 2009

Hard Money vs Fiat Currency

Karl Denninger explained why hard money is not as good in application as it is in theory:

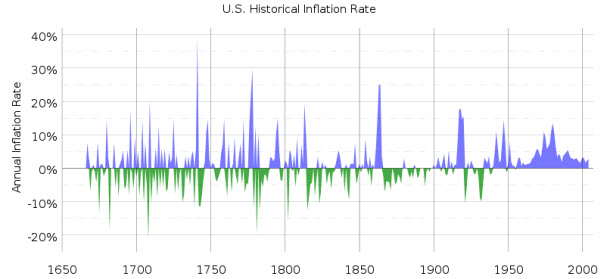

The inflationary and deflationary spikes are caused by the nature of “hard currency”; once dug out of the ground gold, for example, is not destroyed. When innovations in productivity outrun the ability to provision new currency reserves deflation ensues as the mining rate cannot keep up – the resulting deflation causes business and personal bankruptcies. This in turn causes a contraction in GDP but that cannot be balanced with a withdrawal of the currency base since it already exists! The result is a punishing swing between severe bouts of inflation and deflation; this is unacceptable.

Yet our currency still has a significant bias to it…

Yet the history of our fiat money regime as practiced to date, while perhaps “better” in terms of violence, certainly isn’t in terms of bias, which is clearly inflationary, all the time. Why? Simple: Given the proclivity of “choice” the monetary authorities will always choose to try to paper over their friend’s mistakes! This requires inflation, not deflation.

Inflation acts as a silent tax that few Americans actually understand. And so it makes it easy for politicians to spend a bit more without raising taxes. It is politically acceptable to steal a few percent a year from the populous because most just think it happens and few understand that Inflation is Always and Everywhere a Monetary Phenomenon, as Milton Freedman said. I think soft money (coupled with cooking the books on CPI to understate inflation + encouraging short term compensation strategies that encourage massive moral hazard) have a tendency to create less violent year to year changes in inflation, but creates much larger bubbles. So we get improved short term efficiency and more perceived short term stability at the expensive of great instability that blows up every other decade or so.